Retirement savings rules have recently undergone significant changes with the implementation of SECURE 2.0. From age changes for required minimum distributions (RMDs) to more opportunities to save with catch-up contributions, read on to learn some of the fundamental changes from this legislation and how they may impact you and your comprehensive financial plan for retirement.

What is SECURE 2.0?

With more than half[1] of Americans behind on their retirement savings, the SECURE Act 2.0 is the most recent endeavor by Congress to tackle Americans' financial readiness for retirement. After months of negotiation between House and Senate leaders, it was signed into law on December 29, 2022, as part of the Consolidated Appropriations Act (CAA). This law aims to upgrade the SECURE Act of 2019 and includes several significant changes from a financial planning perspective for those at or near retirement.

How could SECURE 2.0 affect my retirement savings?

The #1 biggest expense facing many retirees today is taxes. While your W-2 income may decrease or go away in retirement, if you have built up your savings in traditional retirement accounts, you will have a significant tax bill to navigate during your retirement years. However, those who take time to understand how their retirement accounts will be taxed and to review the latest planning strategies available have a great opportunity to lessen this overall burden and enjoy the benefits of compound tax-free growth.

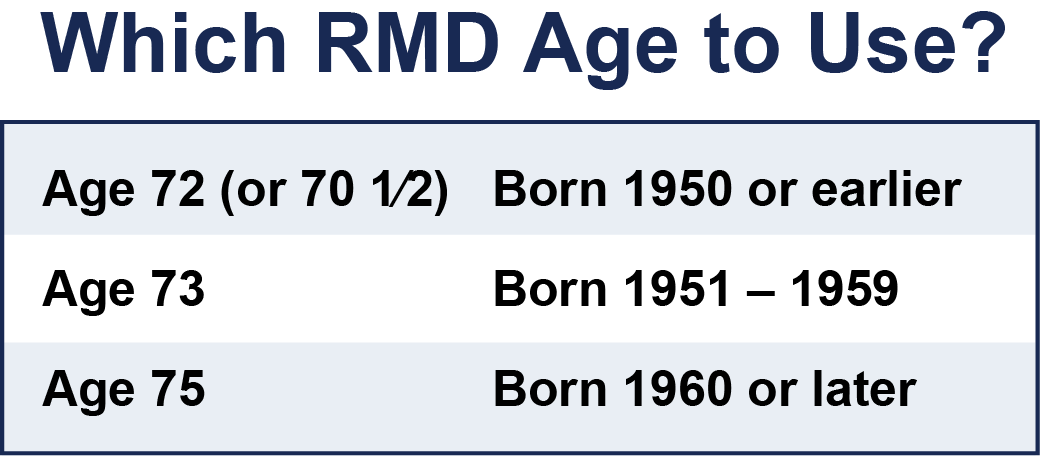

Required Minimum Distribution (RMD) Age Change

One of the notable changes in SECURE 2.0 is the increase in the age at which an individual must begin taking RMDs from retirement accounts. The age has been increased from 72 to 73 years, starting from January 1, 2023. In addition, beginning in 2033, the age will be raised again from 73 to 75 years. Note that those already subject to RMDs under the old rules must continue with their existing schedule, including if you turned 72 years old in 2022, you must take your first RMD by April 1, 2023.

What this could mean for you

The increase in RMD age under SECURE 2.0 provides an opportunity for those who don't need the money to delay RMDs; however, delaying RMDs may lead to larger future distributions based on higher account balances and shorter life expectancies. To avoid this, strategic distribution planning may be beneficial, such as converting savings from traditional retirement accounts to Roth IRAs over a series of years before RMDs begin. By reviewing your tax brackets and strategically filling the gaps to take advantage of lower income tax rates, you can reposition assets for future tax-free growth.

Catch-up Contribution Limit Increases for Retirement Plans

For those nearing retirement, SECURE 2.0 creates more savings opportunities through catch-up contributions. IRAs and Roth IRAs have a limit of $6,500 for 2023 (up from $6,000 in 2022) and a $1,000 catch-up contribution for individuals age 50. Starting in 2024, this catch-up amount will be indexed annually for inflation.

While the retirement plan catch-up contribution limit for individuals aged 50 and older will remain at $7,500, starting in 2025, individuals aged 60 to 63 will have the option to contribute up to $10,000 of additional catch-up contributions. This amount will be indexed for inflation annually.

One important new consideration, starting in 2024, workers with wages over $145,000 will be required to deposit catch-up contributions into a Roth plan in after-tax dollars; this wage threshold will also be adjusted for inflation annually.

What this could mean for you

In addition to more catch-up savings opportunities, this may mean the ability to move more total funds into tax-free Roth accounts by rolling after-tax money from a workplace retirement plan into a Roth IRA. If you have a mix of pre-tax and after-tax money in your retirement accounts, it is important to understand how rollovers must be handled to avoid creating a taxable event or paying double taxes on these after-tax dollars.

New Rules for Qualified Charitable Distributions (QCDs)

Another significant change introduced by SECURE 2.0 is related to Qualified Charitable Distributions (QCDs). Individuals aged 70 ½ or older can donate up to $100,000 directly from their IRA to a qualified public charity or private foundation each year, which counts toward the RMD requirement.

Beginning in 2023, a new option is now available to take advantage of the QCD exclusion. An individual can make a one-time contribution of up to $50,000 from their IRA directly to a charitable remainder unitrust, charitable remainder annuity trust, or a charitable gift annuity. This option is subject to additional rules and requirements, so it's essential to consult with a CPA to understand the nuances of making a QCD election.

What this could mean for you

If you are charitably inclined and want to put your RMDs to good use, QCDs are a great option to avoid the impact of taxes on your charitable gift—both for the non-profit organization and your individual taxes.

Rolling 529 Funds to Roth IRA

Starting in 2024, SECURE 2.0 will allow individuals to redirect unused funds from a 529 education plan, up to $35,000, to a tax-free Roth IRA. The Roth IRA must be in the name of the student beneficiary, and the 529 plan must be in place for a minimum of 15 years.

What this could mean for you

If you did not use all 529 funds for education for your beneficiary, moving them to a Roth IRA avoids creating a taxable event for you and extends the potential for years of tax-free growth for the recipient.

Emergency Access to Qualified Plans

SECURE 2.0 introduced a number of new exceptions to the 10% early distribution penalty for withdrawals before age 59 ½, including for the birth or adoption of a child, terminal illness, domestic abuse or in the event of a natural disaster.

What this could mean for you

While these exceptions will be helpful to those in these difficult circumstances, it's important to consider retirement savings a last resort for emergencies. Also, note these funds will still be subject to income taxes even if the early-access penalty fee is waived.

With constantly evolving tax laws, including a variety of new provisions and effective dates to consider under SECURE 2.0, it is important to work with a qualified advisor to create a comprehensive financial plan for your retirement. To discuss how these changes impact you and your family, please use the link below to schedule a consultation with one of our knowledgeable advisors.

Want more education on taxes in retirement?

Video: Taxes in Retirement

Learning Center: Retirement

[1] https://www.bankrate.com/retirement/retirement-savings-survey-october-2022/